Buying guide

How can I estimate my car finance costs?

Getting your next car on the road is often a purchase that requires some financial assistance.

For most of us, buying a car is one of the biggest financial investments we'll make. Regardless of your own particular budget, getting your next car on the road is often a purchase that requires some financial assistance.

Thankfully there’s a handy tool on lots of car listings that allows you to estimate the financial costs of buying a particular car – helping you work out if it’s an affordable purchase for your budget, and what the car loan repayment amounts are likely to look like.

Check your finance costs in only a few steps

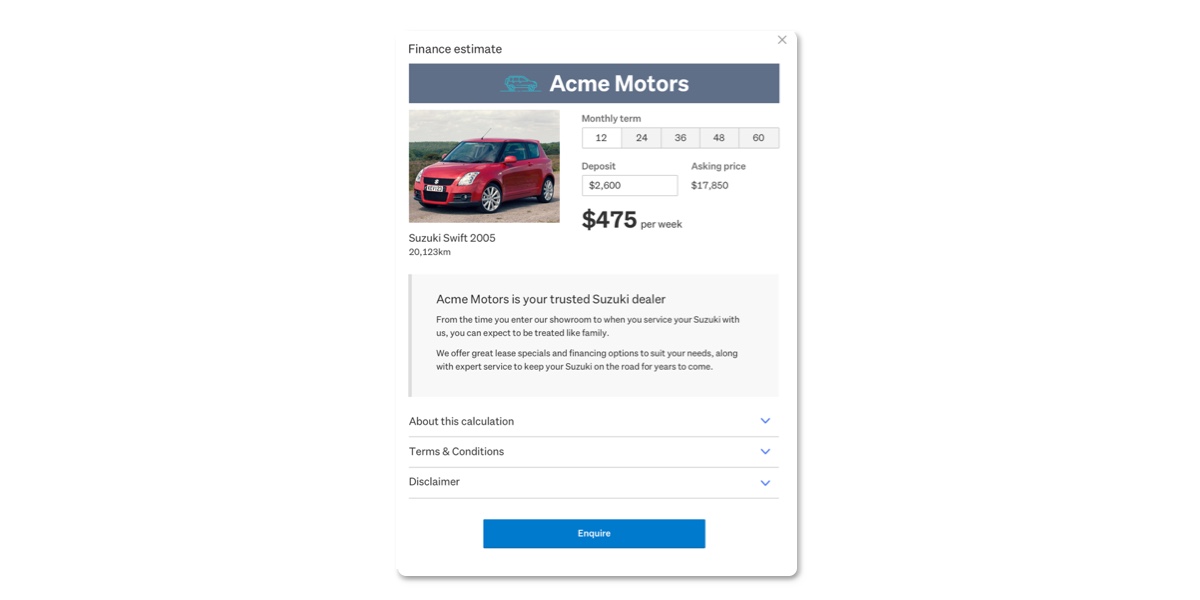

Underneath the price box on a car listing, look for the Finance estimate and select ‘More info’ to input your budget. You’ll then be able to check the repayment estimates based on your own preferences.

Select a loan term time over which you’d like to make the repayments on the car. You can choose to spread your payments over 12, 24, 36, 48 or 60 months.

In the ‘Deposit’ section, enter the amount you want to pay upfront as an initial deposit on the car. The loan repayment calculator will work out what the repayment amounts will likely be for you by evaluating the amount borrowed (based on the ‘Buy Now’ asking price for the car), and your chosen repayment time frame.

Tips for buying with finance

Try testing what the repayment amounts would be over a variety of different payback periods – this will allow you to work out which plan is going to best suit your lifestyle.

If you’re happy with the numbers the Finance estimator has calculated for you and would like to proceed with applying for the loan, you can now click on the ‘Enquire’ button and you can message the car dealer directly.

Other important points to remember:

- The personal loan amount you can receive will depend on your credit score and financial history.

- Every time you open a new loan account, a small loan establishment fee is added to your loan. This is an administrative fee and one-off payment.

- Before accepting the finance package, make sure the interest rate is a figure you're happy with.

- Always shop around with different providers and find the best price for the amount you need to borrow.

If you're successful in securing financing, you’ll soon be driving home in your next car! Before you drive away make sure to learn more about the history of the car and discover if there’s already some existing debt. To get the advice you need, check out our tips on what to do if there’s money owing on the car.

Other articles you might like