Buying guide

What car can you afford to buy?

Whether you’re purchasing a car outright or using a loan, the car you choose will largely be dictated by your budget.

Whether you’re purchasing a car outright or using a loan, the car you choose will largely be dictated by your budget. So how do you know what sort of car you can afford?

Price guide

Our price guide will give you an indication of what you might need to pay to get the car you want. Click the ‘Buying’ tab and pop in the make, model and year to see what price similar cars currently listed on site are selling for (or you can just enter the number plate of a specific car you’re interested in and we’ll find those details for you).

If the price results are too broad, try narrowing your search by including an odometer range.

Car finance

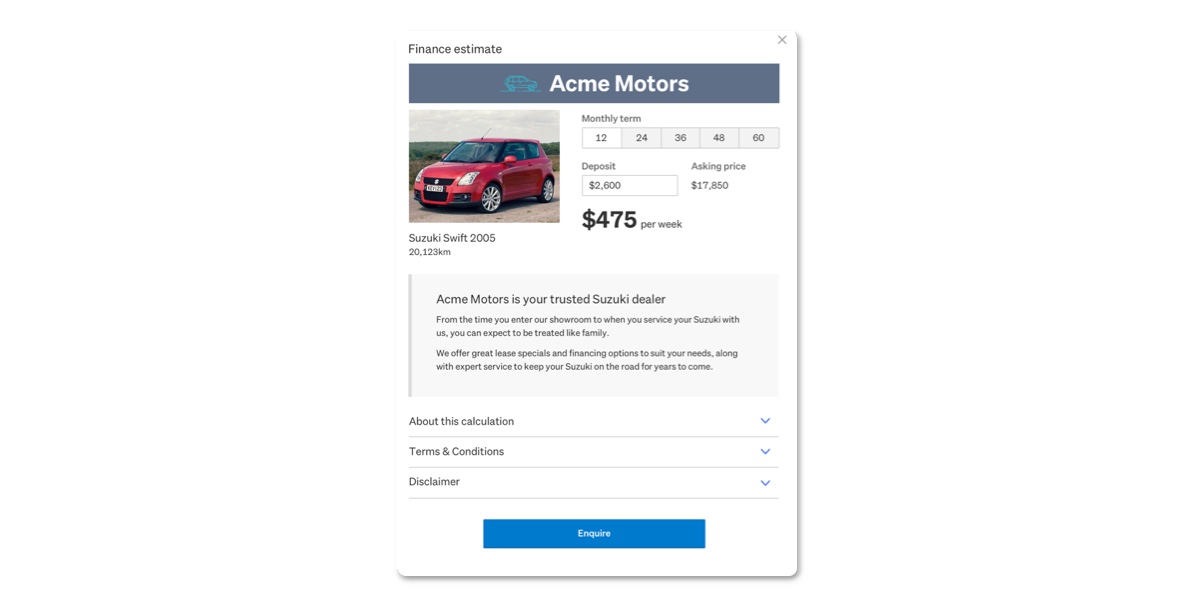

Once you have an idea of how much you may need to spend to buy the car you’re after, you might want or need to consider car finance to cover the difference between your savings and the price of the car. A number of our listings have a finance calculator to help you understand what your repayments could look like.

There may also be an upfront establishment fee and an on-going monthly maintenance fee. Different lending providers offer different interest rates, so it’s worth shopping around to find the most suitable offer for you. Make sure you read all of the documents carefully and don't sign anything that you don't understand or don’t agree with.

If you opt for car finance remember:

Other considerations

It’s also a good idea to take into consideration the potential ongoing costs your car might require. For example, the bigger the engine the more of a gas guzzler it’s going to be. The more powerful the horsepower, the higher the insurance premiums. Do you want a diesel? Road use charges (RUC) come into effect as well.

Also, consider the pros and cons of buying a used or new car:

Now that you’re confident about the sort of car your budget will allow you to buy, it’s time to consider who you’re likely to buy the car from – a dealer or private seller – and what to expect from the process.

Other articles you might like