State of the Nation 2024

Last updated: 2 April 2024

Look inside the hearts and minds of Kiwi buyers and sellers, and the future of property in NZ.

Foreword: Insights to guide you in the year ahead

Trade Me Property’s Head of Classifieds Alan Clark reviews this year’s key findings

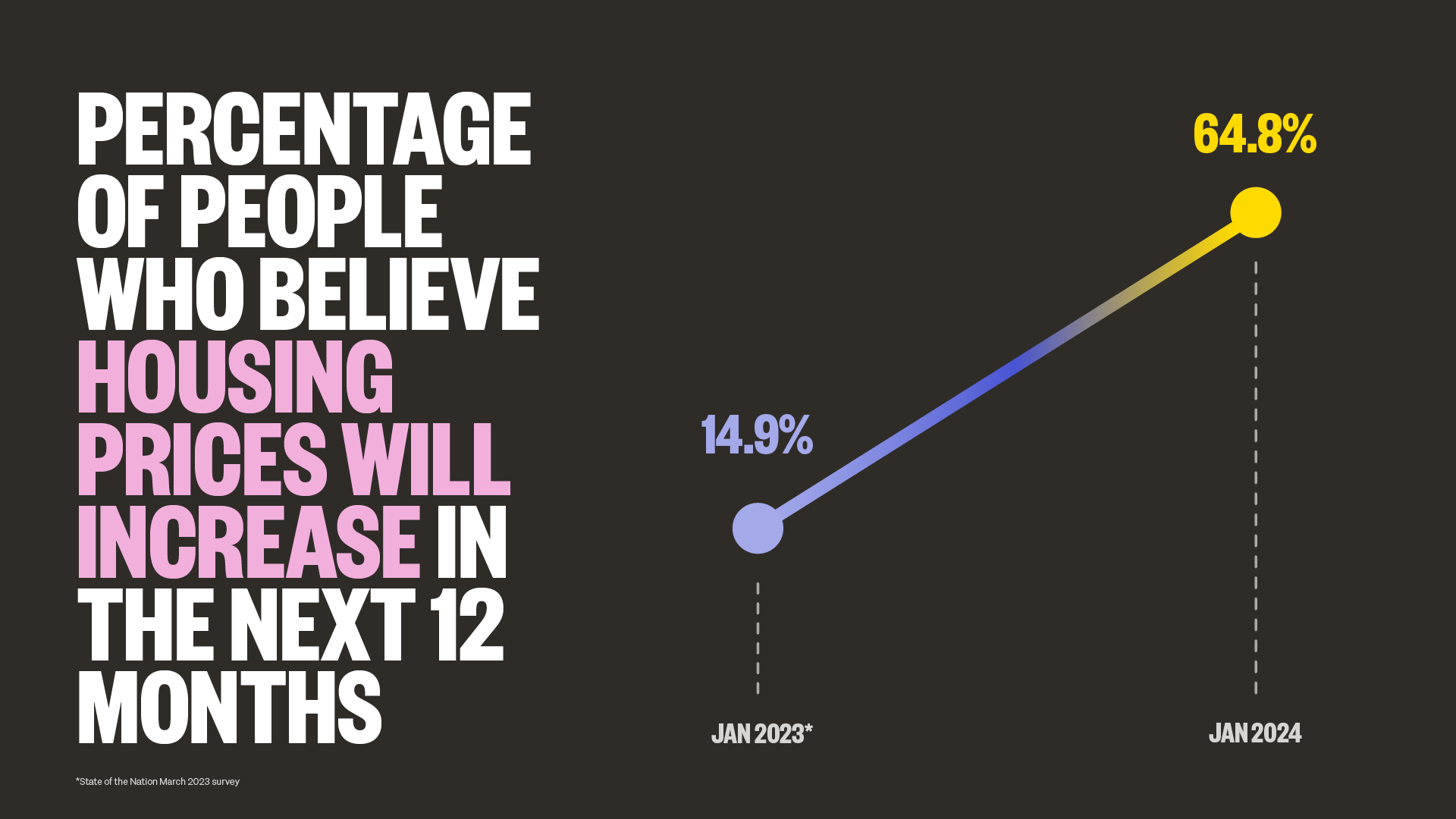

Over the last few years, in a post-Covid landscape, the nation has seen some big shifts. In 2024, it’s great to see that, despite intense pressure from the rising cost of living, Kiwi are feeling so much more confident in the property market. In January last year only 14.9% of people we surveyed thought that housing prices would increase in the next 12 months. Today that number is 64.8%.

People are willing to compromise in order to buy

Buyers are eager to purchase houses - and they are willing to compromise on the property’s size and quality in order to secure a home. A huge 89.1% of respondents were flexible in multiple aspects including size and condition.

After a tumultuous year in the property market, and with families feeling the squeeze of the cost of living, trust is the key driver when a seller is choosing an agent. Our surveyants told us that information and insights often play a key role in driving their confidence and trust.

An economic overview: The road ahead for Aotearoa

An economic overview with Infometrics' Chief Economist, Brad Olsen.

Pressures continue to mount for the New Zealand economy, with high interest rates being partially counteracted by record-high net migration. Overall, the economy faces a subdued outlook over 2024.

Inflation continues to trend lower, with the latest data showing annual inflation rate of 4.7%pa in the December 2023 quarter. But current pricing pressures are still considerably above the Reserve Bank’s 1-3% target range and the 2% mid-point.

Net migration remains at near-record high levels, with the peak expecting to have occurred in late 2023. Over the December 2023 year, the high levels of inward migration are equivalent to adding another Taupō District to the country around every second month.

Record high net migration contributed to the strongest population growth for New Zealand since 1946, with an extra 146,000 people living in New Zealand at the end of 2023. Such intense population pressures are adding further demand to already stretched parts of the economy, including housing, with rental inflation continuing to accelerate as demand for rental rose faster than supply of new rentals in 2023.

High population growth also supported higher labour market outcomes across the board. More and more people are available for and looking for work, which has seen the working age population and labour force expand.

High net migration has fuelled strong jobs demand even as the number of job ads in the market at present continues to drop, as businesses across New Zealand pull back on hiring intentions in tough economic conditions.

Retail trade data from Stats NZ shows that even with record-high population growth and still too-high inflation, actual spending levels fell in the December 2023 quarter from a year earlier. On an inflation-adjusted basis, spending volumes have been falling for eight consecutive quarters, and on an inflation-adjusted per-capita basis, retail trade volumes per person.

Falling household spending activity reinforces the Reserve Bank’s view that its plan to ease inflation is working. But with inflation still too-high, the Reserve Bank has signalled that it doesn’t intend to change monetary policy settings quickly.

In its February 2024 Monetary Policy Statement, the Reserve Bank maintained the official cash rate (OCR) at 5.50%, and also signalled that the OCR might remain at that rate until early 2025 – although we expect there may be enough evidence for a cut in the OCR in the second half of 2024.

When interest rate cuts do begin, they are unlikely to be large and quick, with the Reserve Bank much more likely to make small, considered adjustments downwards to interest rates. Anything larger or more rapid might risk inflation flaring up again, an outcome the Reserve Bank will worry about more than overdoing the current response.

Despite all the challenges facing the economy, inflation is trending in the right direction and interest rate relief is expected within the next year, albeit not a huge amount of relief will be forthcoming. The current economic outlook is still broadly consistent with a “soft landing”, with more optimism building for the future, alongside careful restraint at present.

What’s on the mind of the nation? The impact of the everyday economy

The biggest concerns and priorities for New Zealanders this year - and how the property market is bucking the trends.

15% of people feel confident about where Aotearoa’s current economy is heading. Over 2023, we saw a deterioration in economic confidence; as people felt the impact of rising costs of mortgage payments, groceries and insurance. 3 in 4 people say the cost of living is having a big impact on their lives. While the average NZ salary across all bands jumped by 5.9% in 2023, which helped to offset inflation; ‘better pay’ is still cited as the number one reason that people are looking to change jobs. The economy and finances were consistently cited as respondents’ top life concern. In response, New Zealanders are cutting down on discretionary spending.

Biggest life concerns for Kiwi

- “Mortgage rates, fuel and food prices”

- “Rising costs with wages not rising to match”

- “Food costs and insurance… costs constantly rising”

Consumer spending changes in the last 12 months

- Categories Kiwi are spending less: Personal shopping (47.9%), Big ticket durable goods (46.8%), Entertainment and Food (44.8%), Travel (43.1%).

- Categories Kiwi are spending more: Services (72.5%), Groceries + household items (70.6%), Petrol (56.1%), Mortgage repayments/rent (44.5%)

A shift in priorities and behaviours

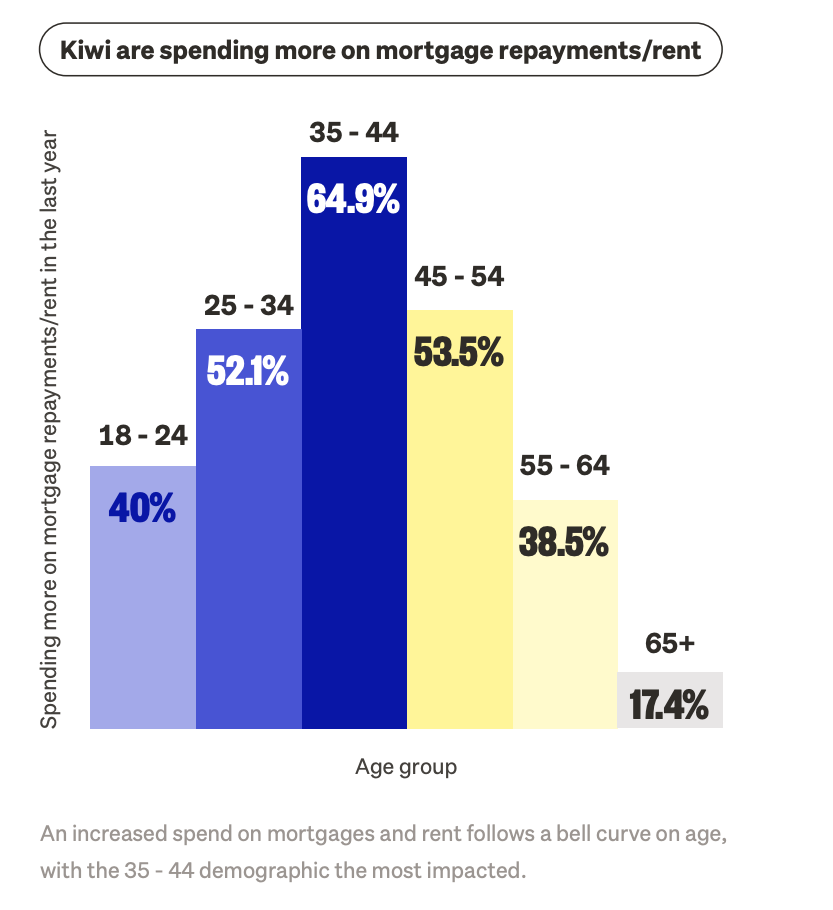

Kiwi are spending more on mortgage repayments/rent

Karina Reardon, Head of Strategic Partnerships at mortgages.co.nz says the bell curve is likely because people are living at home for longer and delaying the purchase process, which sees this particular age group fit into the first home buyer category.

“Historically, New Zealanders fix the bulk of their mortgages so what we are potentially seeing is this group that have purchased a home 2 or 3 years ago when rates were low at 2.99%, now having to refix their loans at much higher rates. Because they haven’t had much of a chance to pay down the principal portion of their mortgage this group are now paying nearly 4.5% more in interest which can be thousands of dollars a month.”

On Trade Me Marketplace, we are also seeing the nation trying to make their dollar stretch further.*

- 42% of people who have items they could offload say that the rising cost of living has made them consider selling secondhand more often, which is a 4% increase when compared to 2022.

- 47% of people say they’re buying more secondhand items than they did before to combat the rising cost of living.

*Trade Me Circular Economy survey 2024

The bright light of the property industry

While there are signs that pressure could slowly be easing, with inflation falling to 4.7% in December (the first time it’s gone under 5% since September 2021)*; the current pressure on spending remains. This coupled with a feeling of uncertainty about the economic path ahead, has led to a nation proceeding with caution.

The good news? The property market is proving to be an exception. This in turn has led to a bigger appetite to buy - 27.6% of respondents intend to purchase this year; up 6% on last year.

The 2024 buyer mindset

Building a strong relationship with an understanding of each demographics’ behaviours, motivations and concerns.

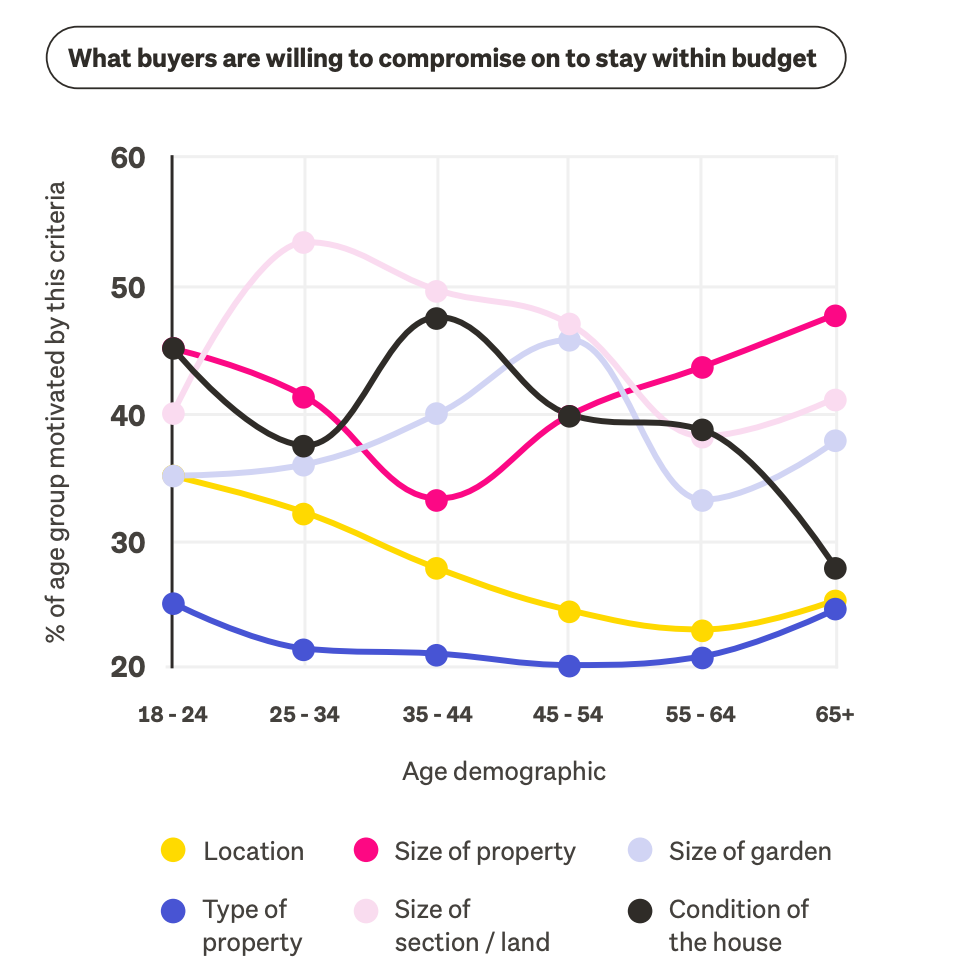

Affordability is key - and buyers are willing to compromise

Buyers are still eager to purchase houses - and are willing to compromise on property size and quality to do so. Only 10.9% of respondents would not compromise on any aspect of the property they were looking to buy.

Which would you be willing to compromise on to stay on budget?

- 40.8% said they would compromise on the size of their property (This is mirrored in what we see onsite - median floor size of watchlisted houses experience a drop as property prices increase; and vice versa)

- 44.8% - Size of garden/outdoor space

- 21.4% - Type of property

- 26.1% - Location

- 38.7% - Condition of house

What does this mean for the market?

Gavin Lloyd, Trade Me Property Sales Director, weighs in.

“Sales people in some cases are really selling the dream. We talked about the shift we’ve seen in consumer behaviour as people change their spending habits to make their dollar stretch further. This mindset appears to be present in the property market too; with the condition of the house being one of the largest areas of compromise - people are leaning into DIY, and the idea of doing longer term improvements. Type of property (e.g townhouses vs apartments) remain a non- negotiable for nearly 4 in 5 Kiwi.”

Buying trends to track

Is condition compromise a growing behaviour?

As Gen Z begin to look at housing, this mindset around condition compromise may further increase. 93% of Gen Zers have shopped secondhand in the past six months, compared with 74% of those 75 years+.* Likewise, the condition of a house is the first equal area our 18 - 24 year old surveyants are willing to compromise on.

The allure of Work From Home

While people are willing to compromise on a room size - there seems to be an exception to this: offices. 29.1% of people feel it is important that the next property they purchase has an office/space they can work from home. The top search term for 2023 on Trade Me Jobs is also ‘work from home’. This showcases the clear value a remote working option has on the NZ psyche. As salary increases, so too does the importance placed on having an office/space to work from at home.

Buyer intentions and motivations

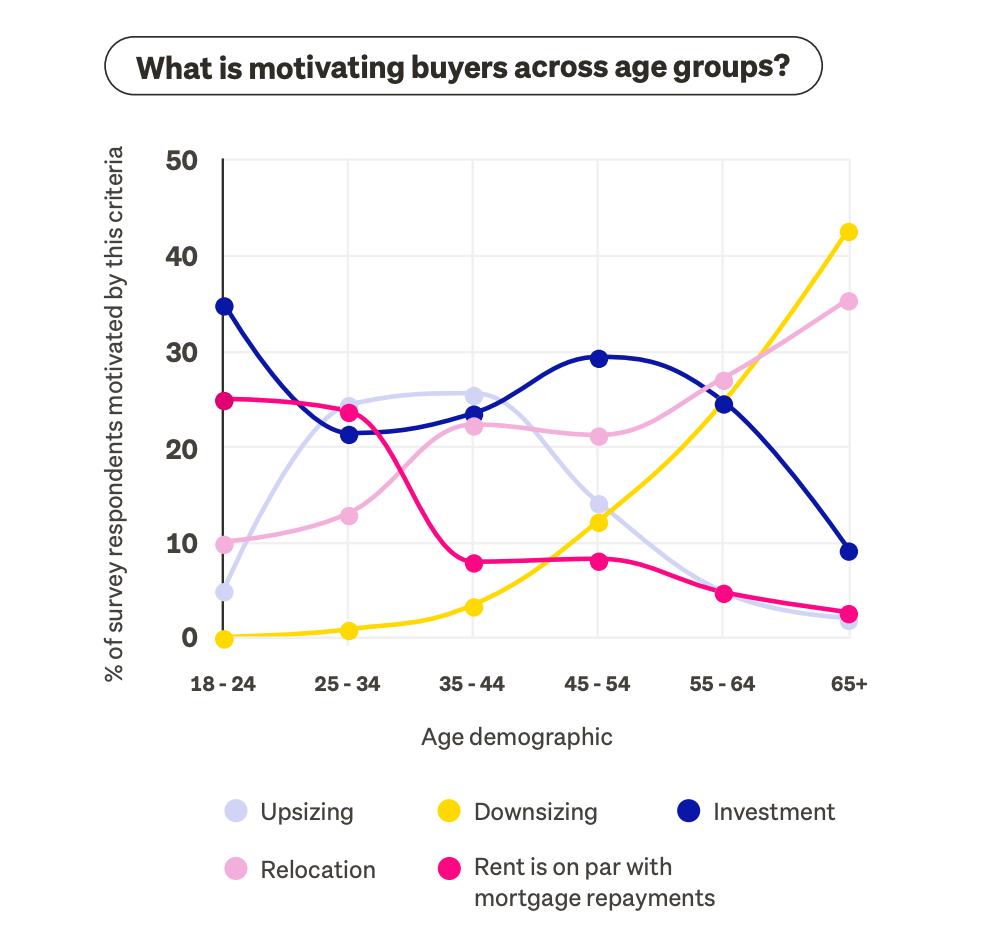

To help sellers understand their prospective buyers and drive fruitful open home conversations, we’ve taken stock of buyer sentiment and priorities across multiple age groups.

Buyer intentions and motivations

Our survey respondents were as follows:

- 18 - 24 - 2.5%

- 25 - 34 - 10.4%

- 35 - 44 - 18.7%

- 45 - 54 - 23.3%

- 55 - 64 - 25.7%

- 65+ - 19.2%

525 answered without sharing age

A Double Click on Age Demographics

While no one knows better than a real estate agent that every buyer is different; commonalities in stages of life often lead to similar motivators and detractors amongst age brackets.

Gavin Lloyd, Trade Me Property’s Sales Director, breaks down the different mindsets.

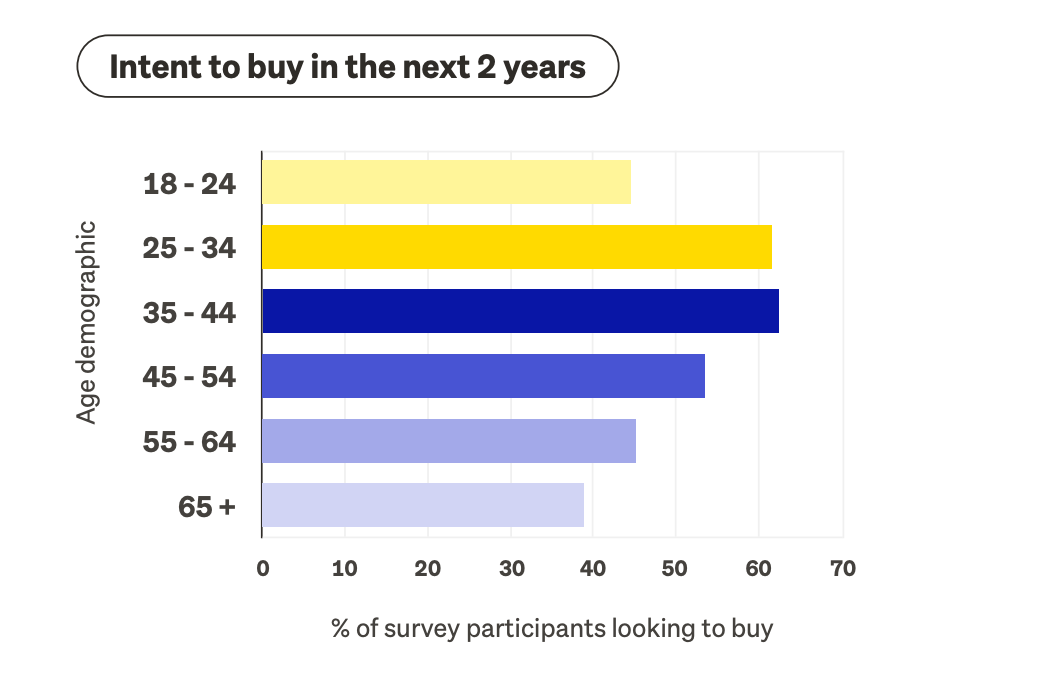

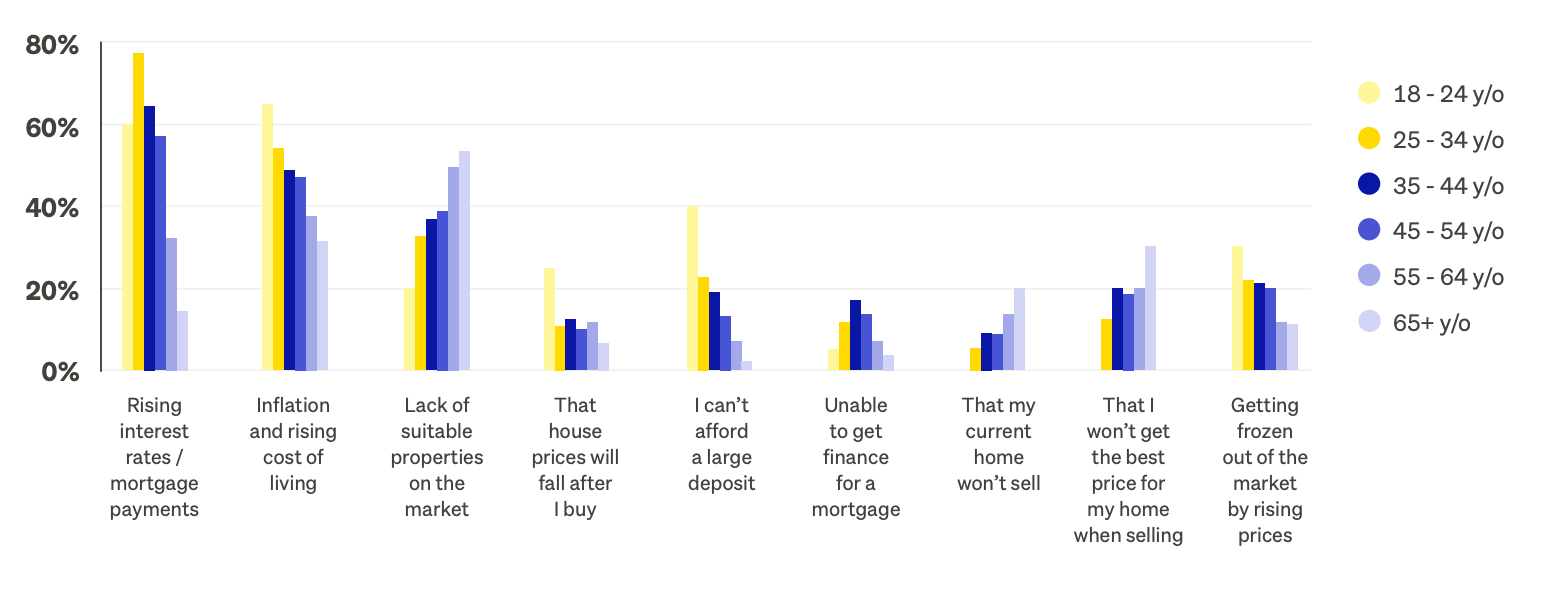

18 - 24 - “This age demographic of buyers are keen to get on the property ladder, and generally view their first purchase as a stepping stone. This makes them flexible on size and location; however the type of property (standalone vs apartment vs townhouse) is very important to them as they’re likely imagining on-selling. While 44.4% of the people surveyed in this demographic said they are looking to buy in the next two years, their biggest concerns are all financially based, suggesting there will be significant barriers. A drop in appetite for urban properties represents a golden opportunity for first-time buyers.”

25 - 34 - “With the second highest intent to buy (61.5% in the next two years), this demographic is split between first home buyers and those already on the ladder. Their main motivations mirror this - split between the individuals upsizing and those keen to get a foothold in a moving market. This was one of the demographics most impacted by rising mortgage rates, and this financial burden is clearly evident in their willingness to compromise on size of both land and house of their next property.”

35 - 44 - 62.3% of 35-44 year olds surveyed intend to buy in the next two years "This demographic was the hardest hit by rising mortgage rates, so the intent to buy really highlights the fact that property is a very attractive investment for many Kiwi. As well as upsizing (this is the highest demographic who are looking for a home with an office), this cohort places a higher priority on relocation than their younger counterparts. They also value location slightly above the average - likely due to schooling considerations. Prioritising school zones also speaks to why a lack of suitable properties is seen as a concern - they are more restricted as to what’s coming up in a specific area.”

45 - 54 - “This age group’s biggest motivators are investment and relocation - and these speak directly to their concerns. While thematically the concerns are the same as the 35 - 44 demographic, this group is slightly more concerned about the lack of suitable properties, and slightly less concerned about the rising interest rates. This makes sense as more often than not, this group is financially well off and are aspiring to find their dream home.”

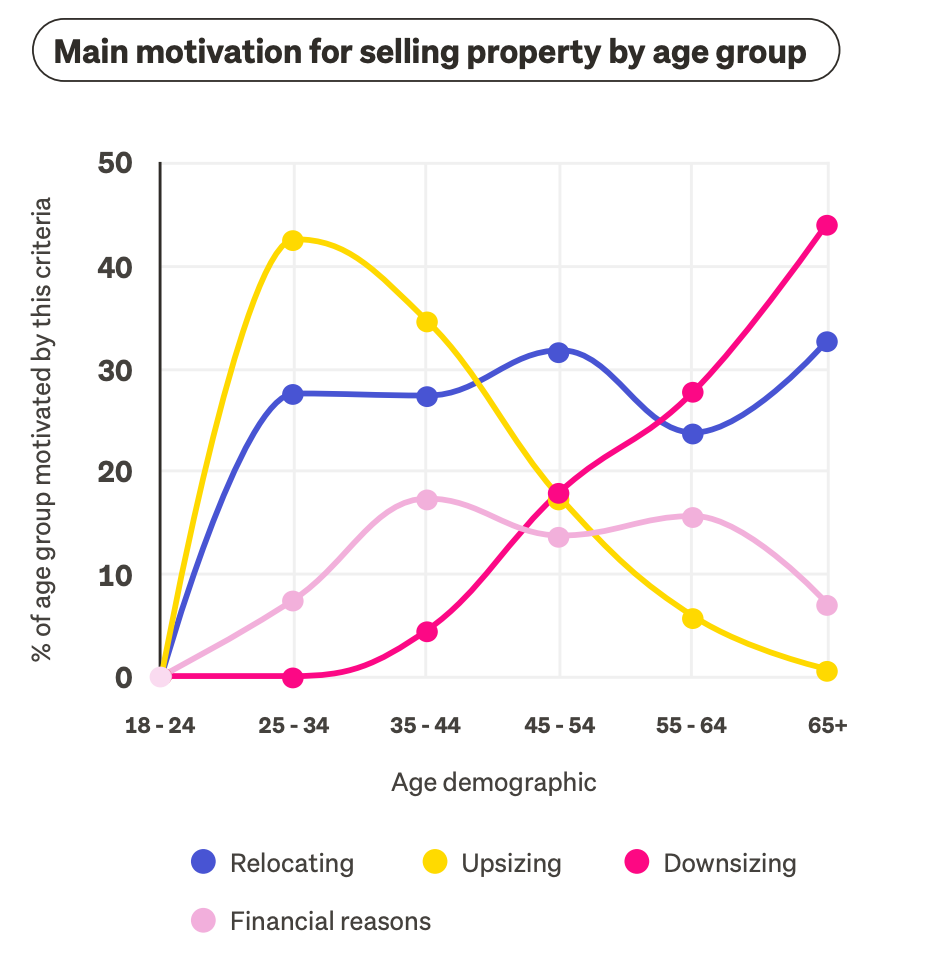

55 - 64 - “Here, we see a decreased appetite to buy. When they do look to purchase, it’s often motivated by lifestyle reasons - relocation and downsizing. This age demographic placed the highest value on being near nature, and also had the highest intent to move to a less urban location.”

65+ - “This age demographic placed the most importance on location. They also had the highest intent to downsize, and to move to a more urban area - around 50% more than other groups. This group is most concerned about not getting the best price for their house, likely due to the fact that the sale price will impact the money in their bank account; rather than being reinvested in the market.”

Biggest concerns about buying

The 2024 seller mindset

A snapshot into the psyche of those looking to list property.

Of all homeowners surveyed, 23% have intent to sell in the next year, and a total of 40% in the next two.

Though we've seen significant impact of the economy on the lives of Kiwi, when it comes to selling, motivations first and foremost point to ensuring housing suits life needs. The top reasons for moving were cited as relocation, upsizing and downsizing.

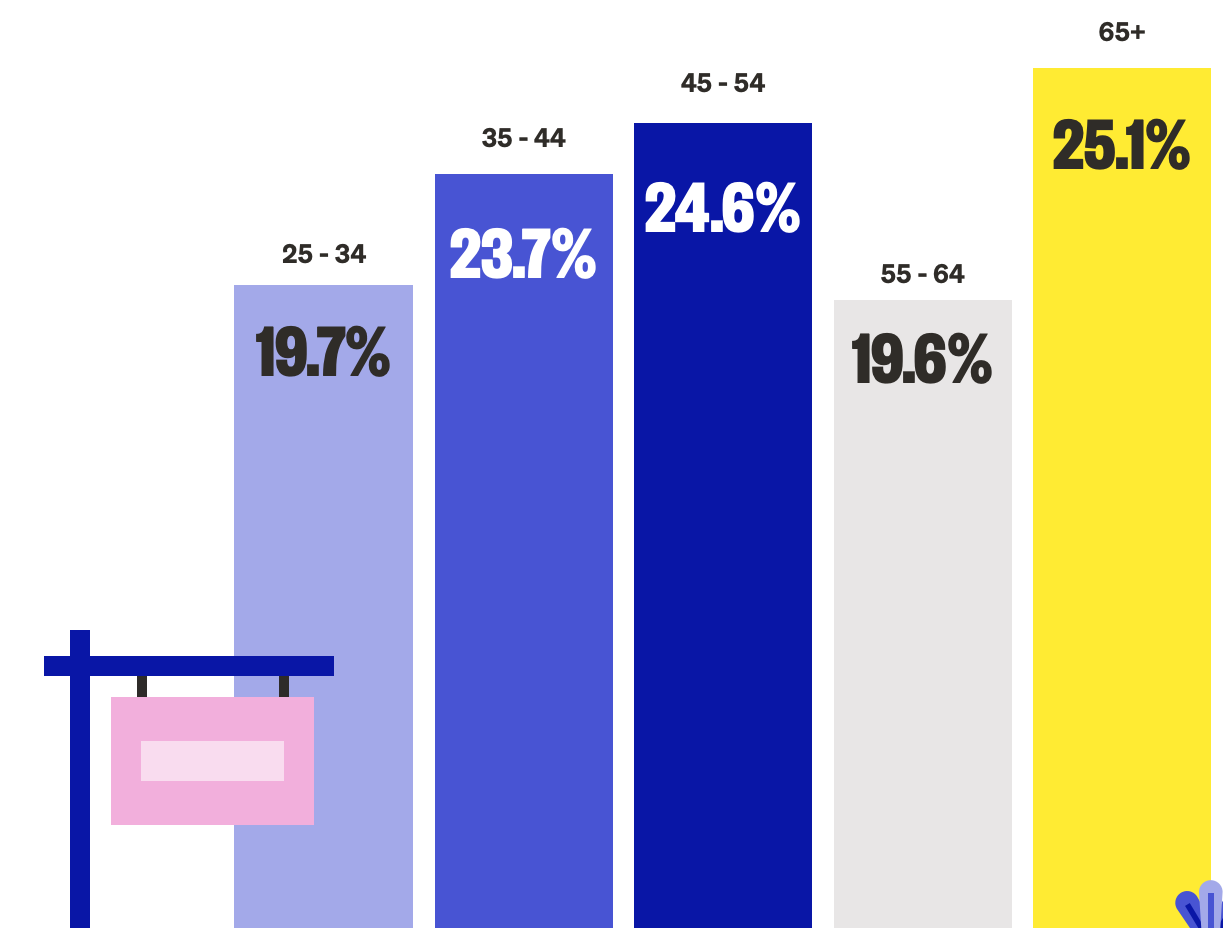

Intent to sell in the next 12 months (by age group)

The push/pull of selling

29% of people looking to sell are relocating. Trade Me Property’s Sales Director Gavin Lloyd says that relocation often signals a full life overhaul - of the job hunters surveyed, 19% said relocation was their top reason for looking. But, while there’s no doubt there’s a fair amount of movement going on, it’s not all in one direction. The search mixes between the centres and provinces - and between the different regions too - remain largely unchanged since 2021.

Main concerns when selling property:

- Getting the price I'm looking for - 68.3%

- This number peaks for 25 - 44 year olds, where 3 in 4 people cite this as a main concern. These ages likely have not had a lot of experience selling a house; and, as a core group looking to upsize, may well be impacted by their ability to hit a certain financial threshold.

- How long it will take to sell - 37%

- 25 - 34 and 35 - 44 year olds are most concerned by the time it may take to sell. As the groups most likely to be upsizing, these are the ages where their next purchase is likely conditional on a sale of their current house and they’re likely looking to get on and off the market quickly.

- Market conditions (34.8%)

- While there is now longer-term confidence in the property industry, after a tumultuous year, sellers are feeling unsure of what the market conditions are in the immediate future. Data and insights will help build this confidence.

The future of property in NZ

Key trends to know and track across the nation.

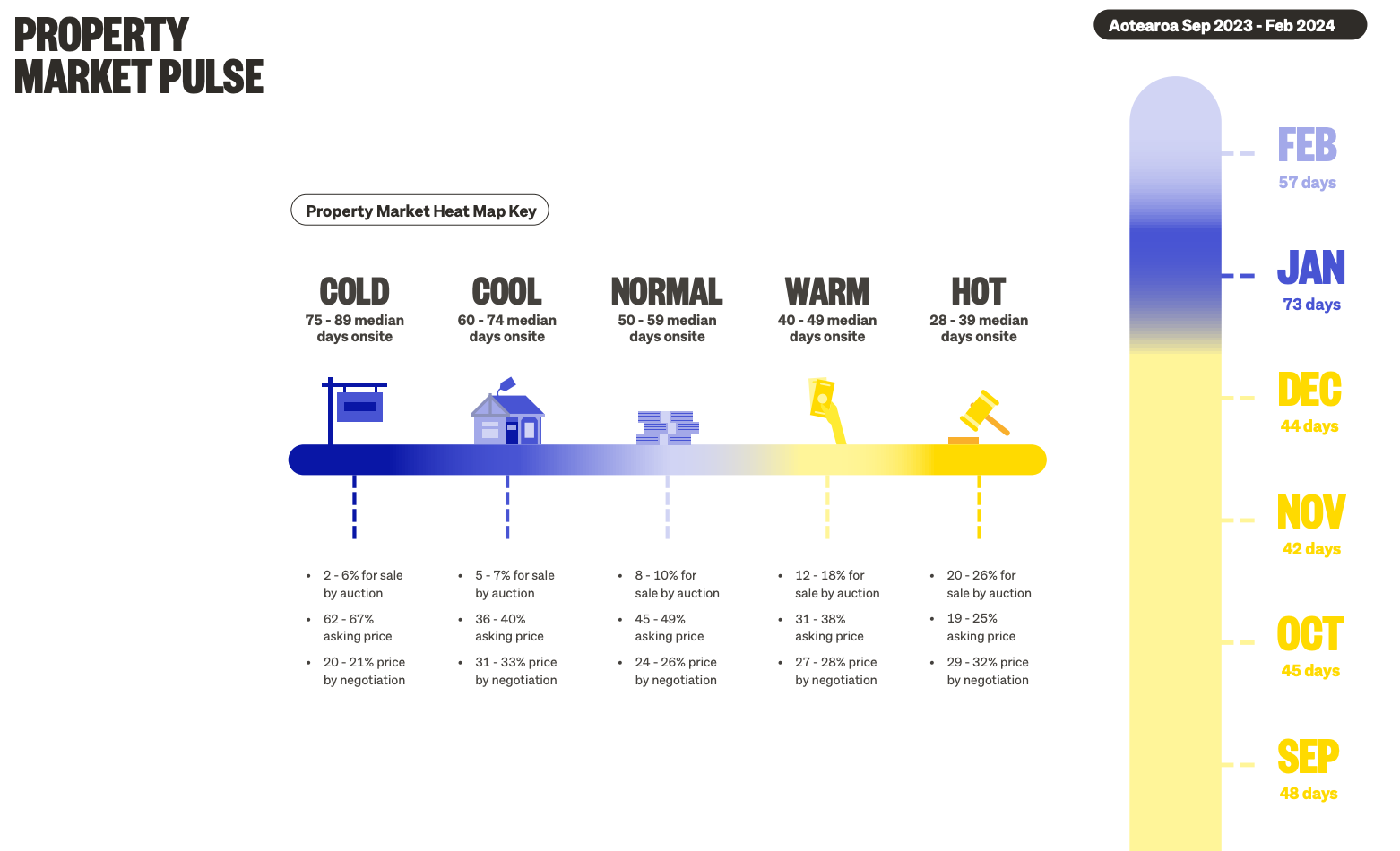

The property market showed signs of strengthening at the end of 2023 - but how long will recovery take? To get early indications, we ran some modelling against the last economic recession in 2008. The results showed that the 2008 Recession and 2022 Bubble recoveries are surprisingly comparable. If the 2022 Bubble follows the same pattern, several years of subdued prices could be expected. However early indicators are pointing to a slightly quicker housing price rebound, which makes sense if we consider 2023 more of a correction following interest rate changes, while the 2008 changes were a response to a broader recession.

Holding pace during the Autumn months will be a good indicator that the uplift of the last few months wasn't just a seasonal one.

Main centres vs provinces: The pricing gaps have narrowed

Since COVID, we’ve seen a significant decrease in the difference between provincial property prices and main centre prices. The size of the gap appears to be stabilising, which may well signal a new equilibrium where the gap is roughly halved. This is consistent with salaries - Trade Me Jobs has seen the wage gap between main centres and provinces narrow post-COVID.

Gavin Lloyd says a more even pricing structure holds big benefits for both major cities (as prices are less of a drawcard for relocation); and for provinces, where owners will of course benefit from the rising prices (especially for those downsizing or investing).

- Pre-COVID - 36% difference between main centre and provincial property prices

- 2023 - 18% difference between main centre and provincial property prices

A wider de-urbanisation?

One contribution to the closing gap may be the changing urban landscape. In January, we saw a 0.6% drop in price across all urban properties. This ties in with what we are seeing in Kiwi psyche. Of those surveyed:

- 14% of Kiwi want a more urban area for their next move

- 36.6% would prefer to move to a less urban location

There is an exception though;

- 50% of the 65+ age group are seeking more urban location

Renters-to-buyers are a window of opportunity

The perception that the cost of rent is on par with mortgage is leading to a growing group of people considering property ownership; which could cause a swell in buyers in the market. In 2020, Trade Me Property saw significant growth in the number of users switching from buying to renting. Factors likely included ongoing property price growth, as well as financial instability during COVID times. From 2020 to 2023, that number stabilised.

At the same time, rental prices have continued to increase, while property prices have declined. This has made property prices seem more attractive comparatively. Cost of rent being on par with mortgage was cited by our renter survey respondents as the number one reason they were looking to buy.

As we mentioned earlier, people are willing to compromise to get on the property ladder, so it can be assumed that renters looking to buy may be compromising on combinations of location, condition and size.

We're now seeing fewer people leaving the market, but since February 2023, the number of renters has begun to decrease, while the number of buyers has increased - suggesting an uptick of people moving from the rental market to the property one.

Karina Reardon, mortgages.co.nz’s Head of Strategic Partnerships says those who waited out the price peak and continued to save for their house deposit will also be contributing to this number. “[Those who waited] are now what we call “buyer ready”. This is supported by the data from clients using our LoanMatch software, where 55% of the client enquiries have a deposit of 10% or greater.”

What the next 12 months will look like from a mortgages perspective

Managing Director of mortgages.co.nz, Marcus Phillips, weighs in.

Many people we are talking to have started 2024 with a greater degree of optimism than in recent years. Whilst there are still unknowns, the clarification of a new government with the relief of a decent summer and the potential for interest rates to eventually fall, has had a positive effect on the outlook of many Kiwi.

The interest rate optimism is reflected by borrowers continuing to strongly favour fixing home loans for 6-12 months in anticipation of rates moving downward. This may happen once the Reserve Bank gains greater confidence in the inflation outlook, but it is hard to know when that will be - probably beyond mid-year. Mortgage brokers are also benefitting from the possibility of falling rates, with first home buyers and investors returning in greater numbers to start the year.

The probable introduction of DTI’s may bring an opportunity for some first home buyers with banks able to have 20% of loans with less than a 20% deposit compared with 15% currently. The consensus is, that there will be no immediate impact from the likely introduction of DTIs mid-year, but I suspect this could have a greater impact than anticipated, particularly when interest rates start to decline, and we navigate this policy change.

It is possible new technologies entering the NZ mortgage market will change how we research and obtain home loans, particularly considering advancements in AI alongside the emergence of open banking. Finally, it will be interesting to see the results of the Commerce Commission enquiry into the competition in personal banking, and what changes if any this delivers. Keep an eye out for the report due to be published by 20th August.

Download the full Report here

*State of the Nation survey methodology: This survey was conducted during January 2024 and collates answers from 2,557 individual New Zealand-based respondents. Respondents were a sample of Trade Me members who had been active on either Trade Me Property, Trade Me Motors, or Trade Me Jobs in the previous 12 months.