Professional sellers

Latest ecommerce insights and Trade Me trends Q1 2023

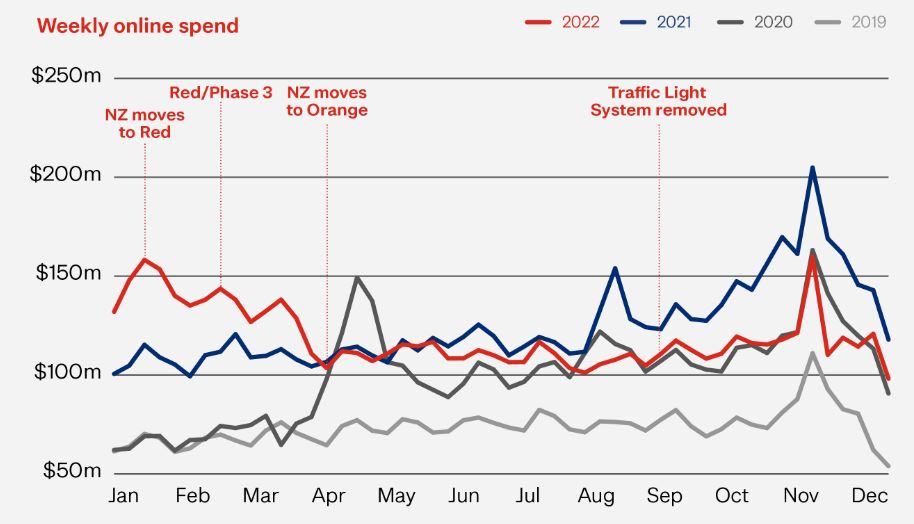

2022 and beginning of 2023 has been tough for ecommerce across the board.

Source: NZ Post latest eCommerce insights

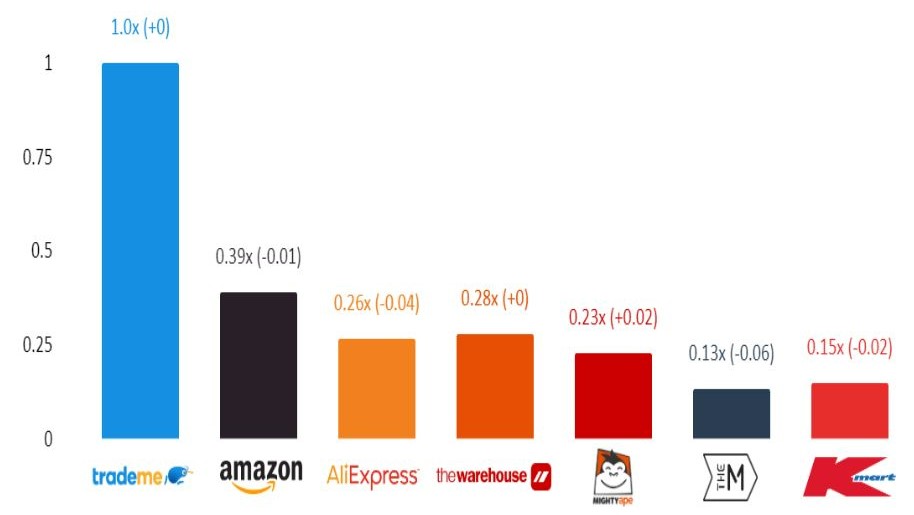

Trade Me Marketplace continues to be the market leader in both web and mobile phone app (January 2023)

Source: Data is taken from SimilarWeb