Feature article

NZ interest rate predictions: 2024 & 2025

We’ve rounded up NZ mortgage rates forecasts from economists & experts.

Last updated: 2 May 2024

The last few years have been an interest rate rollercoaster. They were at their lowest point in history in late 2021 - then by 2023 rates climbed to a 15+ year high. To help you plan for the future, we’ve gathered NZ interest rate predictions for 2024 and 2025 from leading economists and government agencies.

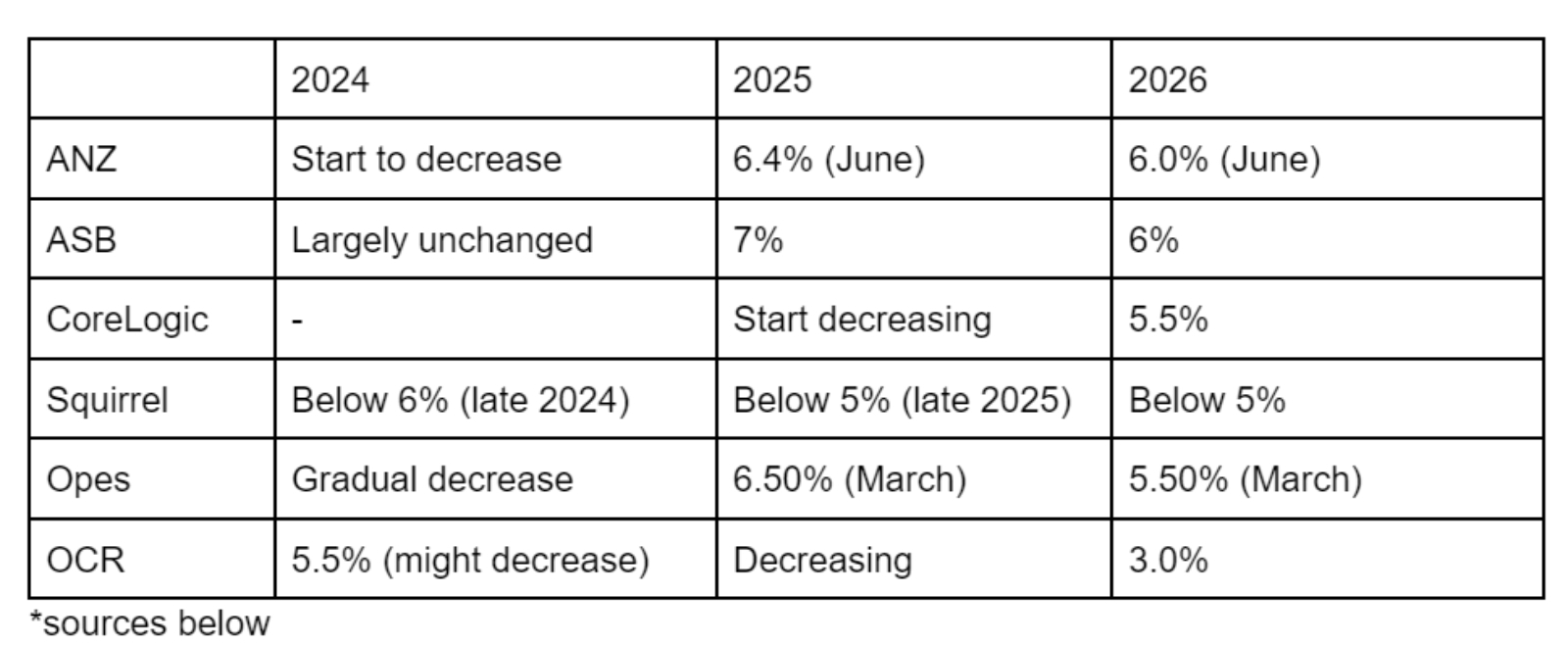

NZ mortgage interest rates forecast 2024 & 2025

1 year fixed rate forecasts & OCR

ANZ

ANZ’s property April 2024 Property Focus report predicts that one year fixed mortgage rates will start to decline from September 2024, when they will be 7.1. From there, the bank expects rates to slowly decline to 6.4% in June 2025, and 6.0% in December 2025. The bank’s breakeven analysis suggests that:

“It is worth considering fixing for perhaps 2 or 3yrs, rather than only 6mths or 1yr, because those longer terms are already cheaper, and come with implied falls built in.”

ASB

ASB’s April 2024 Home Loan Rate Report predicts that all fixed home loan rates should decrease in the 12 months, with one year rates seeing the biggest drops (from around 7.75% to 7% in April 2025). Rates will fall further from there - one year rates are forecasted to hit 6% in two years time.

The bank's analysis suggests that two and three year rates should fall before one year rates - possibly in 2024.

Kiwibank

Kiwibank head economist Jarrod Kerr forecasts that fixed interest rates could decrease by 1% by late 2024.

Westpac

In their February 2024 Economic Update, Westpac’s NZ mortgage rate prediction was that rates should start falling along with the OCR from early 2025.

BNZ

In their April 2024 Interest Rate Research paper, BNZ has forecasted that the OCR will decrease from 5.5% (the current rate) to 3% by Q2 2026. If this happens, mortgage interest rates may follow a broadly similar trend, falling by 2.0 to 2.5% in the next two years.

Interest rates may be headed down in the mid to long term.

CoreLogic

CoreLogic’s Chief Economist Kelvin Davidson told Newshub that there’s almost no chance of interest rate increases in 2024, but there should be slow steady declines starting in 2025 then stabilising around 5.5%.

Squirrel Mortgages

David Cunningham, Chief Executive at mortgage advice firm Squirrel, forecasts that one year rates could drop below 6% by the end of 2024 and below 5% by late 2025.

Opes Partners

Property advisors and economists Opes Partners predict that one year fixed rates will average 6.5% in March 2025 and 5.5% in March 2026.

What about the OCR?

In its February monetary statement, the Reserve Bank stated that the OCR would need to remain around current levels (5.5%) for an extended period, in order for them to meet their inflation target. Their best guess is that there’s a very small chance of a rate increase in 2024, followed by steady decreases from early 2025 until the OCR hits just over 3.0% in late 2026.

According to Opes Partners, markets are pricing in an OCR cut, possibly as early as September. Other economists are saying that recent inflation figures were slightly higher than expected and this may indicate that the first OCR cut will happen in early 2025.

Interest rates have a huge affect on house prices in NZ.

How long should I fix for?

Long term interest rates of two to five years are currently lower than six month and one year rates. This indicates that banks expect interest rates to fall in the next year or two.

If you fix for a shorter term, such as one year, you’ll have a slightly higher rate right now, but you’ll be better prepared to take advantage if interest rates decrease in the next year.

If you fix for 2+ years, you’ll lock in a lower rate but you may not be able to benefit right away if interest rates decrease.

Another option that many mortgage brokers and economists suggest is to break your mortgage into portions. You could, for example, have half on a one-year fixed rate and half on a three-year fixed rate. This would give you some of the benefit of lower long term rates, but still allow you the opportunity to take advantage if interest rates are lower in a year.

Unfortunately even New Zealand’s sharpest economists can’t tell you what’s right for your mortgage, or where interest rates will be in the future (with any certainty). That’s why you should always structure your mortgage in a way that suits you. If you value security and certainty those longer rates may be attractive. If you’re willing to gamble that rates will be much lower in a year, it may be worth choosing shorter term rates.

Most importantly, it’s always a good idea to get professional advice. Speak to a mortgage broker or financial advisor and they’ll be able to help you structure your mortgage in a way that’s tailored to you and your financial situation.

DISCLAIMER: The information contained in this article is general in nature. While facts have been checked, the article does not constitute a financial advice service. The article is only intended to provide education about the New Zealand mortgages and home loans sector. Nothing in this article constitutes a recommendation that any strategy, loan type or mortgage-related service is suitable for any specific person. We cannot assess anything about your personal circumstances, your finances, or your goals and objectives, all of which are unique to you. Before making financial decisions, we highly recommend you seek professional advice.

Author

Other articles you might like