News Next article

OCR remains at 2.25%

OCR updates and insights from Chief Economist Kelvin Davidson.

By Kelvin Davidson 18 February 2026The economic balancing act

What this means for house hunters

Looking ahead: Flat is the new up?

Past OCR Updates

Late again?

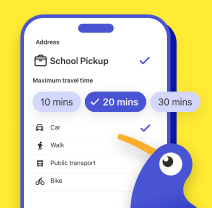

With our new travel time feature, you can find a home closer to the places that matter most. Search by travel time on NZ's favourite property app.

Try it now Author