Discover

Understanding the meaning of mortgage acronyms and terminology

Here’s a quick explanation of what the main mortgage terms mean to help you start talking like a pro.

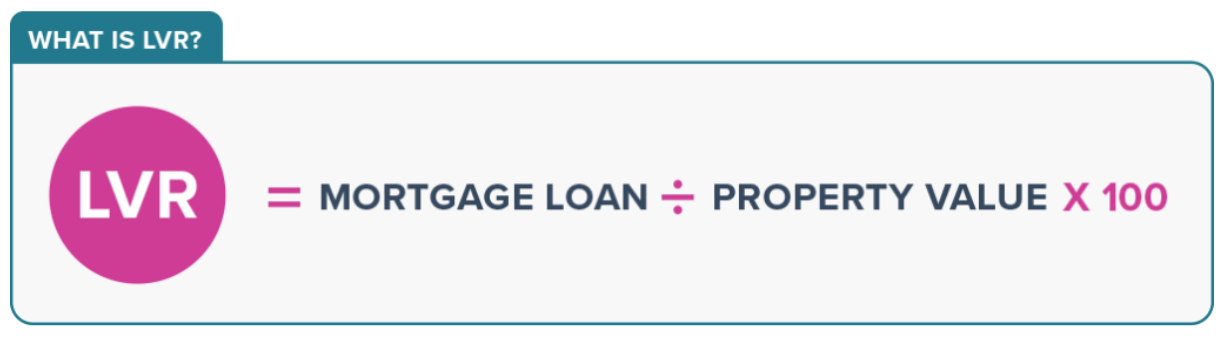

What does LVR mean?

Image provided by mortgages.co.nz

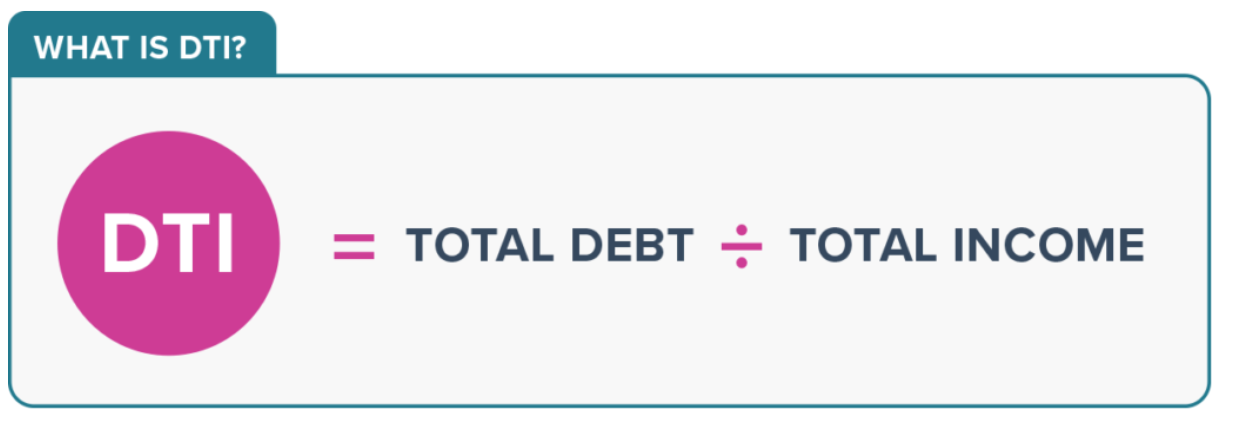

What does DTI mean?

Image provided by mortgages.co.nz

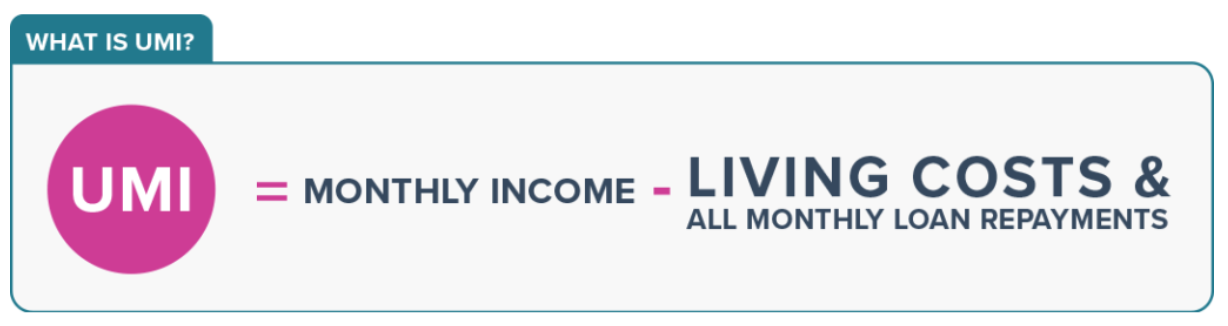

What does UMI mean?

Image provided by mortgages.co.nz

What does AML mean?

What is a credit score?

Authors

Search

Other articles you might like