Buying guide

Interest rate predictions 2026

Make informed decisions

| Bank | 2026 % | 2027 % | |||

|---|---|---|---|---|---|

| ANZ | ANZ | 4.7 (June) | 4.7 (June) | 5.2 (June) | 5.2 (June) |

| ASB | ASB | Remaining near current levels | Remaining near current levels | May rise as economy improves | May rise as economy improves |

| BNZ | BNZ | Flat or increasing | Flat or increasing | Increasing | Increasing |

| Kiwibank | Kiwibank | Plateauing or increasing | Plateauing or increasing | Increasing | Increasing |

| Westpac | Westpac | Increasing | Increasing | Increasing | Increasing |

Our summary of interest rate predictions from the experts

ANZ

Westpac

ASB

BNZ

Kiwibank

A note about advertised interest rates*

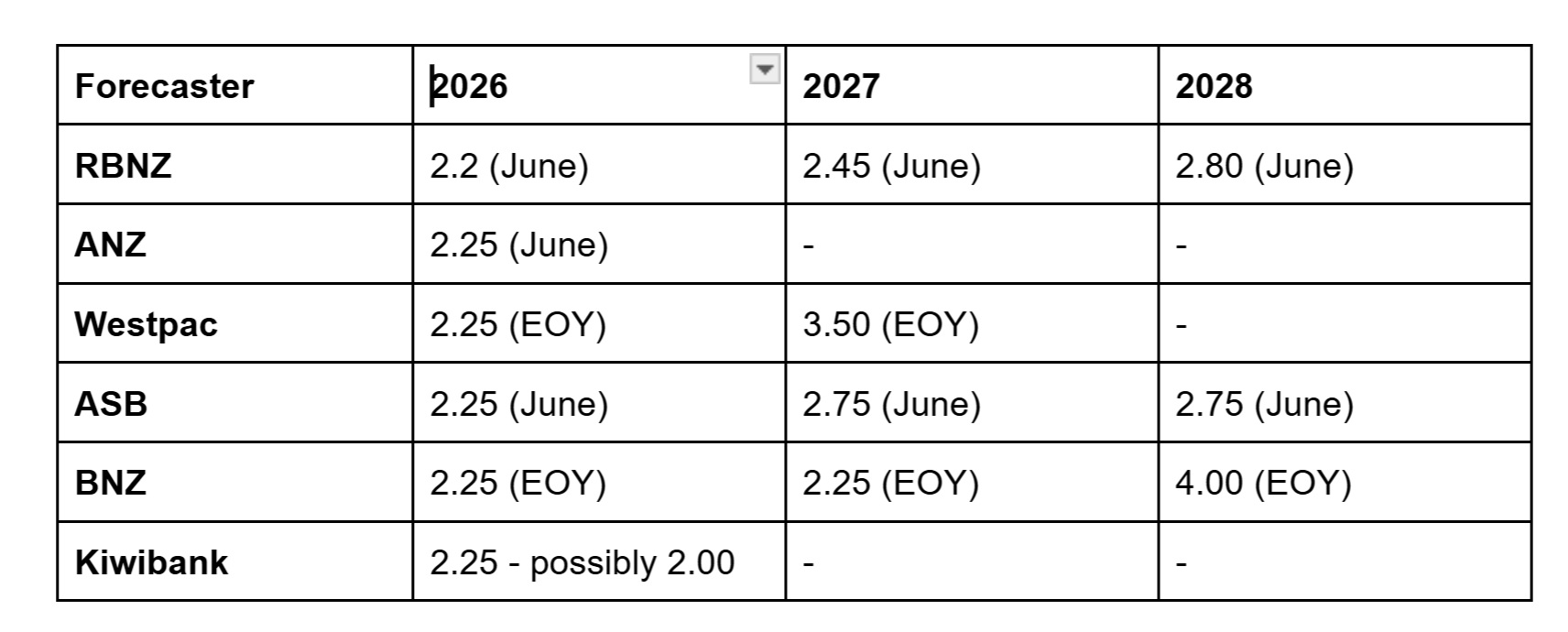

Official cash rate predictions 2025 and 2026

Sources: Bank reports

Our summary of OCR forecasts

The million dollar question: How long should I fix my mortgage?

Opes Partners say the 1 year rate is a great option

Gareth Kiernan at Infometrics argues for shorter term fixes *with a caveat

New Zealand's biggest bank says interest rates are headed downard.

Tony Alexander reckons the three year is the rate

Nicole Pervan, GM of home lending at Kiwibank says it’s all about you

Jarrod Kerr, Chief Economist at Kiwibank, recommends splitting:

Consider break even analysis

The Reserve Bank plays a big part in influencing retail interest rates.

Get expert advice first

Author

Search

Other articles you might like